Market Update: A $500bn sweetener from Japan

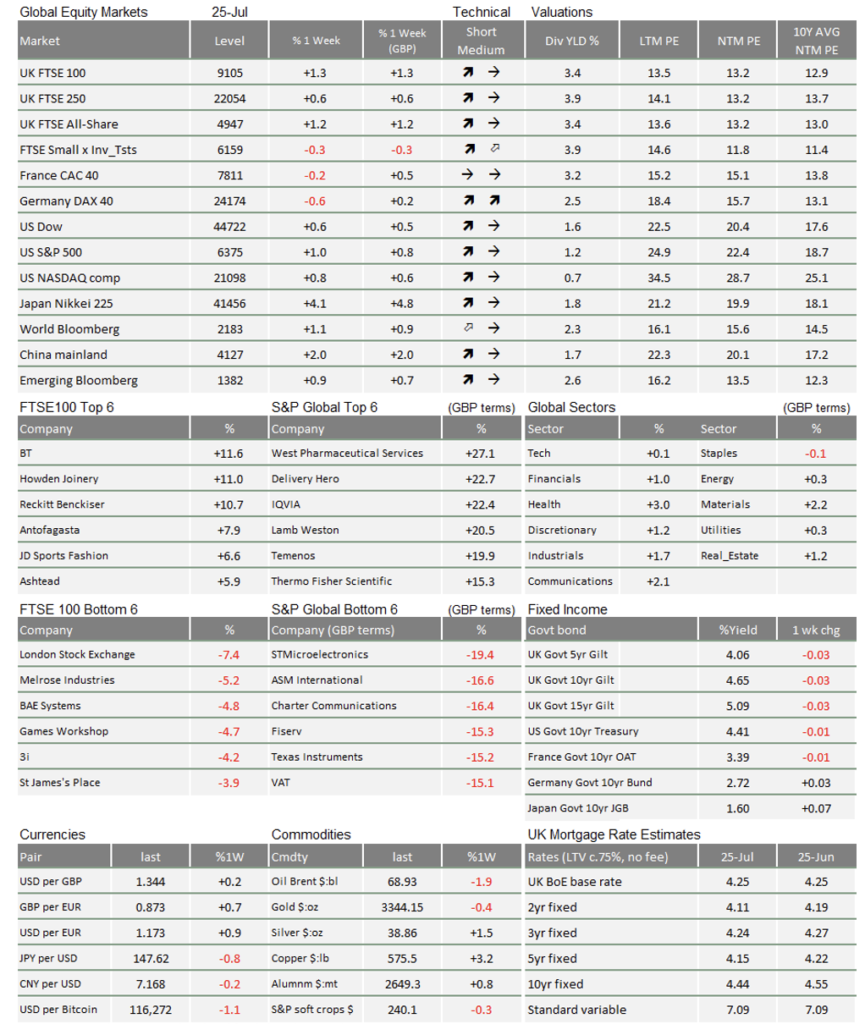

Last week had lots of quite important information but no single aspect has dominated. Equity markets are higher again, bond yields are stable and companies tell us that, on balance, things are difficult but okay. US retail investors are choosing to back riskier “meme” stocks. June’s UK consumption growth was soft and government finances remain under pressure, partly because people are choosing saving over spending.

The US Federal Reserve (Fed) Chair Jerome Powell ended the week still in a job but the Japanese Prime Minister is likely to be on his way out, despite getting a “deal” with the US administration.

A softer summer

The Office for National Statistics said June UK retail sales rose a soft 0.9% versus May, and failing to rebound much from May’s -2.8% versus April. Consumer sentiment also edged down, according to both GfK and the British Retail Consortium. The Purchasing Manager Indices, which measure business confidence, showed July has remained mildly positive although less than hoped, as government finances showed a wider deficit of £20.7bn, well above the expected £17.5bn.

At the heart of this is a rise in the household savings rate, perhaps partly due to “front-loading” ahead of the autumn budget. Still, the current data does not suggest recession, just very cautious households and businesses, which is probably no surprise.

Greater cash savings may well be finding their way into UK stocks, and it also helps the Bank of England look past sticky inflation, allowing them to edge rates further down.

The Fed and Trump

Donald Trump has been attacking Jerome Powell for weeks but the rhetoric became much more strident through last week and the start of this one. Trump most wants to be able to blame “high” interest rates and the rate setters for any weakness in the economy, and as the figurehead, Jerome Powell has become the target. But, just as Trump may not have the power to remove the Fed chairman; Powell cannot dictate interest rates on his own (and neither could any new chairman), and it would be difficult to prove that recent policy has been misguided.

However, although it is a completely different issue, the renovation of the Fed’s headquarters in Washington DC is probably overrunning by $3 billion. That irresponsibility gives Trump the means, if he chooses, to pin the blame on Powell and attempt to make his position untenable if Trump were serious about trying to force lower rates.

Yesterday, and as a guest of Powell, Trump stepped across the road from the White House to visit the renovated Fed building. Despite making a clumsy joke about interest rates, he subsequently said that there was no tension and that he doesn’t want Powell out.

Of course, if he gets rid of a potential scapegoat, Trump will have no one else to blame if the economy weakens or inflation rises. Politically it is better to leave Powell in post for when Trump needs a significant distraction from other news flow. Trump will note that US government bond yields barely moved as he ramped up the pressure, meaning that he could exert power more decisively when he needs to without greatly fearing a bond vigilante backlash.

Japan’s lame duck premier

Japan’s upper house election resulted in a loss of majority for the LDP-Komeito coalition and yet another blow to Prime Minister Ishiba. His first action on being appointed in October was to call an election for the lower house which resulted in the ruling coalition losing its majority there. He vowed to stay on for the sake of stability, thus ensuring months of turmoil (as the FT commented).

None of this appears to matter greatly to Japanese financial markets. Much more importantly, a trade “deal” with the US was agreed with a blanket 15% tariff level being imposed on Japanese exports to the US. Investors liked the fact that this meant that cars (the most important export) will now not face a heinous 25% rate. To sweeten the deal for the US Japanese institutions will lend a huge $500bn “to rebuild and expand core American industries.” to the US. However, the decision on how it will be invested is entirely at the discretion of the US government. Ishiba will find that his voters are not as happy with this as international investors, and he is highly likely to have to make way shortly.

Oddly, the Bank of Japan took the opportunity to reaffirm its hawkishness, saying that this removal of uncertainty would probably enable them to raise rates, as such the Yen went slightly stronger.

Following Japan’s US trade deal , markets now also expect that the European Commission will be able to cut a similar deal . European car maker share prices (such as Mercedes) are, on average, back to the same level as the day that Trump was elected. Holding that level depends a lot on a deal being announced next week.

Further, the European Central Bank met this week and left interest rates at 2%. Its president Christine Lagarde told the press that “We are in this wait-and-watch situation,” and that the economy was now in a “good place”. Markets are now thinking the rate cutting cycle could be over.

US stocks; retail investors versus the hedge funds

Some US retail investors have rediscovered the joy of “Meme” stocks. Perhaps we should call them the “meme generation”. They watch out for companies which are disliked by the institutional hedge funds, but with whom retail investors have some emotional affiliation. Using social media, they club together and buy. It can be expensive for hedge funds to sell shares they don’t actually own; they have to “short” the stock and pay daily fees to keep borrowing somebody else’s shares until they eventually buy the shares back. If the retail investors own enough, they can refuse to lend out the shares to the hedge funds, thus massively increasing the borrowing fees. After a short time, the hedge funds give up and take a loss.

Back in 2021, the Covid cash gave retail investors lots of spare money to invest. Now it appears to be money made from previous profitable trades as well as clever use of one-day options. The fall in option prices is a bonus.

Even if it’s difficult to identify where the trading liquidity is coming from, retail investors appear to beating the hedge fund managers at their own game. The speed with which stocks are picked up and ramped (to use the terminology from a generation ago) is quite remarkable. Meme stocks such as Opendoor, Krispy Kreme Inc and Wendy’s Co were the stars on Wednesday.

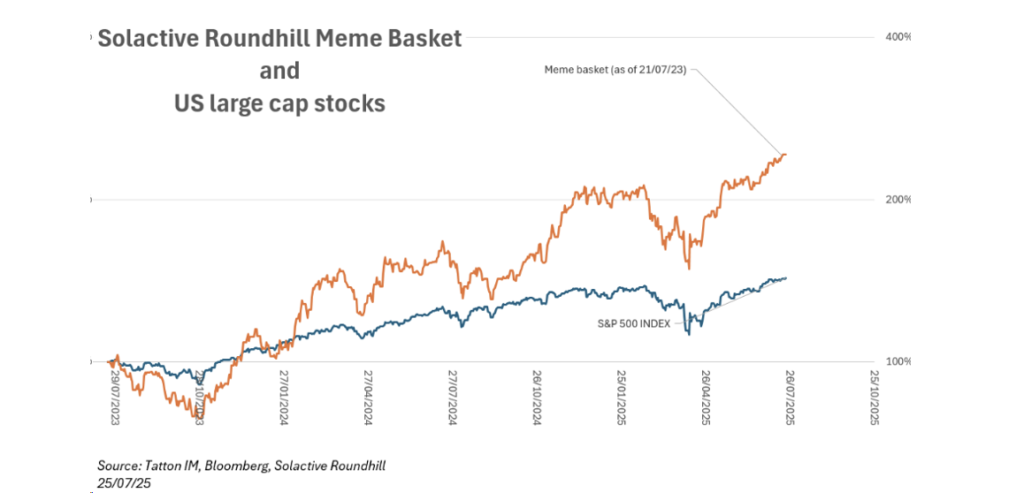

Is meme stock investing a good strategy? Back in 2021, the Solactive Roundhill created a Meme Stock Index of 25 meme shares. Many of the picks such as Tesla and Rivian have done poorly and last year the Index was discontinued after a bout of underperformance from the basket as a whole.

Nevertheless, despite the weak phase a year ago, investing in the stocks themselves two years ago would have generated a total return of 143% versus the S&P 500 total return of 43%.

The truth is that the approach is a form of game-playing rather than investing, involving very high risk stocks with poor fundamentals. As such, it is very similar to how hedge funds themselves gamed institutional investors in the 1990s; high-stakes poker and who has the bigger risk appetite. We say good luck to them.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.